February 13, 2025

An update from Companies House is set to enhance the protection of personal information on its public register. These changes, introduced under the Economic Crime and Corporate Transparency Act, are […]

May 30, 2024

Looking for a tax efficient way to attract and retain top talent? A share scheme option scheme could be ideal. As a business you can offer your employees the opportunity […]

February 8, 2024

Cast your mind back to 2003. Not too distant a memory for the victims of the Halifax Bank of Scotland (HBOS) fraud. Corporate scandals such as this tend to drag […]

November 28, 2024

On October 14th, Jonathan Reynolds, Secretary of State for Business and Trade, announced the UK’s ambitious ‘Invest 2035: The UK’s Modern Industrial Strategy’ through a newly published Green Paper. At […]

January 14, 2025

This year brings a host of personal tax changes that could impact individuals across the UK. From wage increases to pension adjustments and reforms to capital gains and inheritance tax, […]

December 11, 2024

In Labour’s first Budget in 14 years, Chancellor Rachel Reeves presented a series of measures designed to offer targeted support to struggling sectors, promote sustainable investment, and maintain fiscal security, […]

December 2, 2024

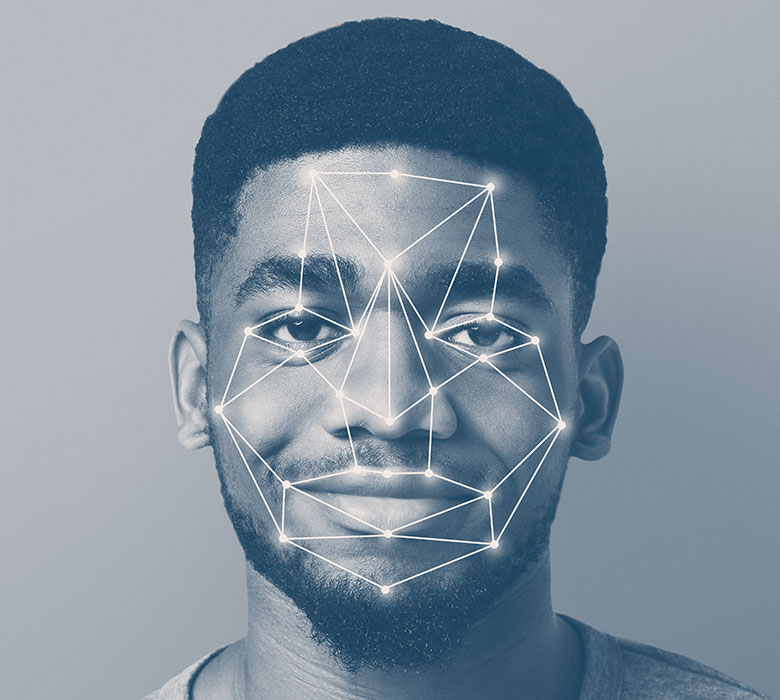

In an important step towards strengthening corporate governance and reducing fraud, Companies House is set to roll out a new identity verification process. This measure aims to prevent the misuse […]

November 12, 2024

In the wake of the recent Budget announcements, many of the most impactful changes are receiving significant attention – but some measures that could influence businesses, investors, and individuals in […]

November 11, 2024

In the latest Autumn Statement, the UK government unveiled a range of fiscal updates that will impact businesses, investors, and individuals alike. Boxed in by Labour’s manifesto pledges not to […]